- Compounders Daily

- Posts

- Costco Stock in 6 Charts

Costco Stock in 6 Charts

Everything you need to know about Costco stock in 6 simple charts.

Today’s Compounders Daily stock is Costco (Nasdaq: COST).

Costco stock has returned 494.4% in the last 10 years and 19,380% since going public in 1985.

Chart by Koyfin. Get 20% off Koyfin with our discount at this link.

Here is a look at Costco’s key metrics and business in 6 charts.

The 30,000-Foot View

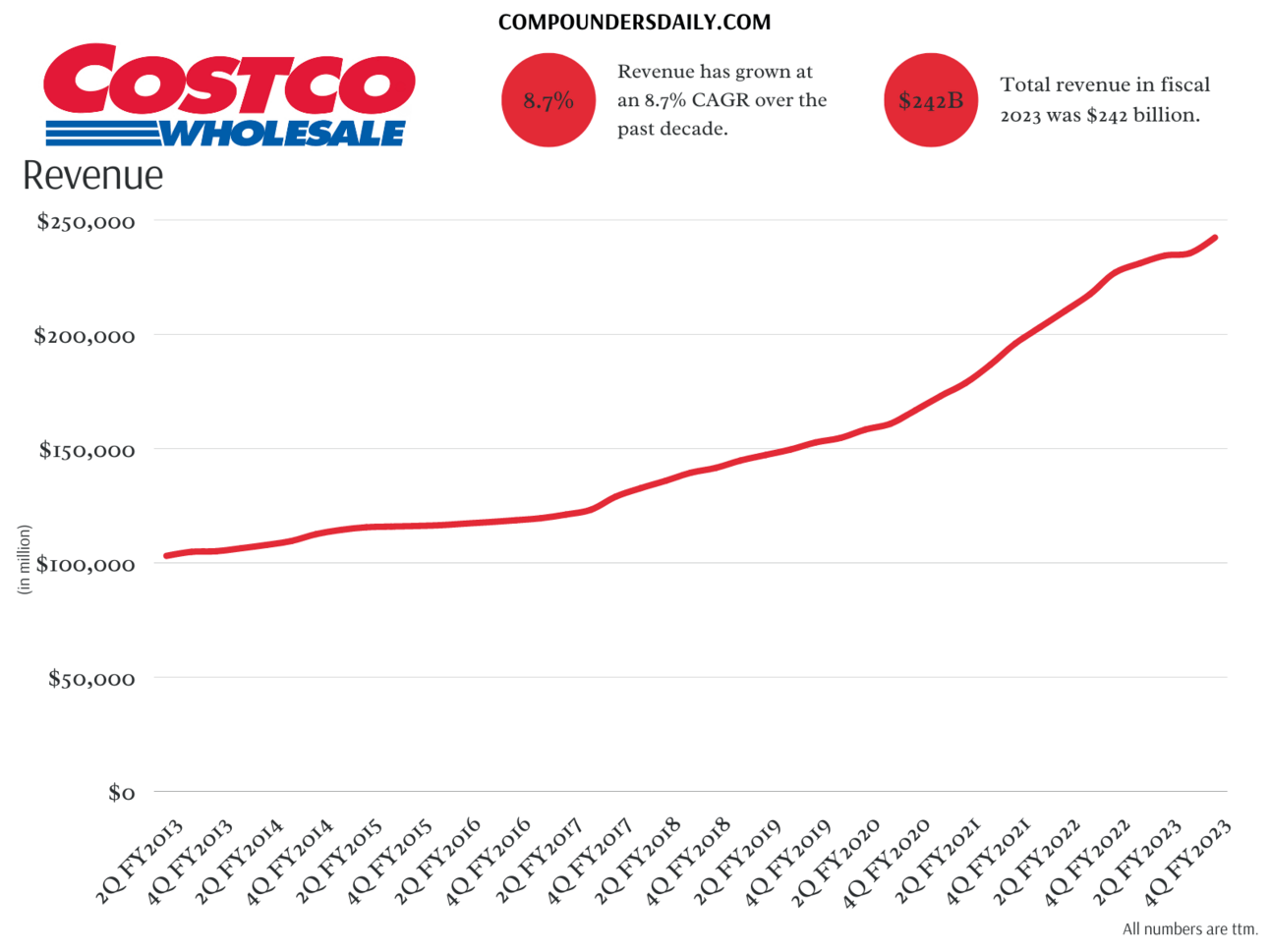

Costco has been a slow, steady growth machine, compounding revenue at an 8.7% rate over the past decade.

Free cash flow broadly tracks net income, which has grown at an 11.9% CAGR, indicating margin expansion over the past 10 years.

How do we make our charts?

It starts with data from our partners at Koyfin, who bring a treasure trove of data to your fingertips. It’s easy to get started with Koyfin and you can get 20% off with this link!

The Business Breakdown

Operating margins have expanded slightly over the past decade, but both gross and operating margins are modest for a retailer.

Return on assets is rising but is still a modest 7.6%.

Membership fees make up nearly all of Costco’s net income, although profit from the store has risen slowly over the past decade.

Did You Know?

How does Costco make money on low margins and low return on assets? It gets to use supplier cash for free! Payables now exceed receivables by $15.2 billion, or over half of Costco’s $29.4 billion investment in property, plant, and equipment.

Dive Deeper Into Costco

Want to dive deeper into Costco’s business? Here are 3 resources we use every day:

Investor Relations: Press releases, earnings, SEC filings straight from Alphabet.

Koyfin: Get financials, charts, transcripts, and much more all on Koyfin. It’s what we use to start research, so you know it’s good.

Quartr: There’s no better way to listen to earnings reports than Quartr. And they recently added searchable transcripts and earnings presentations to the platform.

We will be back tomorrow with another compounder stock.

Help us improve Compounders DailyTell us what you thought of this post. |

Disclaimer: Compounders Daily provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium and Jon Quast may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.

Links above from Koyfin are affiliate partners that provide Compounders Daily with financial support.

Join the conversation